Smartsheet: A spreadsheet-based tool for easy project management

Competing against widely used task management tools such as Asana and Trello, Smartsheet has gained traction across a wide range of companies. Here’s how the cloud-based app works and why it's popular.

Smartsheet is a flexible spreadsheet-centric work management tool designed to track team projects. Launched in 2006, it has 9 million users (almost 1 million of them paid users) and is deployed by nearly 100,000 companies, ranging from Google and Netflix to the US General Services Administration.

Its success stems from its ability to appeal to a wide range of business users, specifically project managers, according to Chris Marsh, research director at 451 Research, part of S&P Global Market Intelligence. For Bellevue, Wash.-based Smartsheet, this means combining a familiar spreadsheet format with richer work management and collaboration capabilities.

“It has gained viral appeal among business leaders and their teams as a tool flexible enough to address lots of different work use cases…that didn’t need involvement from project management specialists or business analysts,” Marsh said in an earlier interview.

How does Smartsheet work?

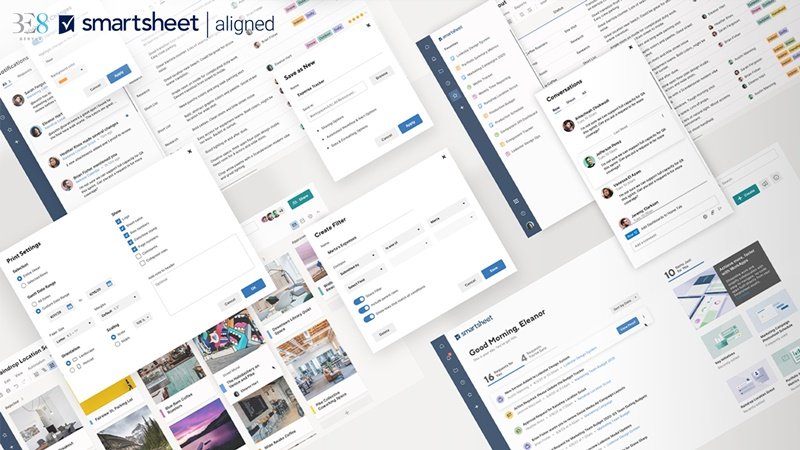

Work in Smartsheet centers around “sheets” that contain information relating to a particular project or projects.

Users can generate custom reports that collate data from sources within multiple sheets, enabling an overview of sales activity across a team, for instance. And dashboards can be created to provide a high-level overview of data within sheets, combining widgets such as charts, metrics and reports.

Smartsheet offers a range of integrations with other collaboration, productivity, and business applications, including Microsoft Teams, Google Workspace, Atlassian Jira, ServiceNow, and Salesforce.

Workflow automations can be set up with a range of triggers and actions, such as multi-step approval processes or notifications to colleagues via Slack of an impending deadline.

Smartsheet also offers a no-code platform, WorkApps. Introduced in 2020, WorkApps lets users create simple apps by packaging information from sheets, forms, and dashboards into a simple interface.

Smartsheet pricing

Although Smartsheet offers a free 30-day trial, there’s no freemium option; all of its tiers have a monthly or annual subscription cost. Individual subscribers pay $7 a month (when billed annually) for the Pro tier, offering access to all sheet “views,” automated workflows, WorkApps (access only), and other features, though there is a limit on the number of sheets, reports, and dashboards.

The business tier, at $25 per user per month, increases the number of accessible sheets to 100 per user, removes the limit on boards and reports, and offers additional features such as custom branding.

Enterprise users, who can negotiate a custom pricing plan depending on the number of users and specific needs, gain access to the full range of admin controls — such as single sign-on and enterprise access control — and can build custom WorkApps.

A new premium pricing plan, Smartsheet Advance, was unveiled at the company’s Engage event this summer. Available to enterprise customers, Advance includes three tiers: Silver, Gold, and Platinum, providing access to a range of additional features. This includes granular management over information sharing; and the ability to upload data, sync and share Smartsheet data with business apps such as Salesforce and Microsoft Dynamics 365.

What’s next for Smartsheet?

Although it has similarities to more traditional project management apps, Smartsheet is part of a new generation of work management tools that includes the likes of Airtable, Asana, Monday.com, Workfront, and Wrike. It also faces competition from the big tech players, namely Microsoft and Google, which have similar products.

Smartsheet ranked high in analyst firm Forrester's recent report on collaboration tools, “Forrester Wave: Collaborative Work Management Tools, Q4 2020,” with strong ratings for automation capabilities. The company’s product vision and roadmap were also seen as strong points.

Smartsheet, which filed for an IPO in 2018, raising $150 million, has seen strong growth in recent years, gaining traction with a range of smaller and enterprise-size organizations. Revenues reached $385.5 million in fiscal year 2021, up 42% year on year, with the largest individual customer deals worth north of $3 million. The company’s most recent quarterly financial results showed a 68% increase among customers who spend $100,000 a year, an indication of wide usage within organizations.

The company has been expanding its workforce rapidly; it now has more than 2,100 staffers, up from 460 at the start of 2017.

And in another sign of maturity, Smartsheet has become increasingly acquisitive, buying four companies since its IPO, including Brandfolder, a digital asset management software vendor, for $155m last year.

For more information about Smartsheet, contact us here. Click